Why do you want to do it?

….Promptly asked my 9 year old son, when i told him that i have signed up for upcoming Vasaloppet1. (a 90km cross country ski race in central Sweden.)

I struggled to find a suitable answer but could only mumble i don’t know. :)

He knew it well i have very little to none knowledge of skiing, let alone x country skiing.

Later that night i thought about it. Why do i want to do it?

Maybe i wanted to test how resilient i am.

May be some adrenaline rush? or i’m fool enough to sign up for something i have little to no knowledge.

Or perhaps it was midlife crisis :). Yes i recently turned 40.

This thinking led me to a different tangent.

Why do we do what we do? specially in business perspective.

Cost of action vs Opportunity cost vs Cost of doing nothing

… have always baffled me. lets dive down bit more on the pros and cons of each (supported by tons of data from history).

When the project failures rates are all time high and 70% of transformation projects fail to achieve outcomes2. What if those projects were never started?

Let’s do a quick comparison between three before proceeding..

Cost of action.

- Direct, tangible and measurable resources spend to execute a decision.

- often called Capex (capital expenditure in business terminology)

WHAT YOU PAY

Opportunity cost.

- The hidden cost of choice not made.

- When committing to start project A, what is the cost and revenue lost by not doing the other alternatives. i.e project B or project C.

WHAT YOU GIVE UP

Cost of doing nothing.

- As implied by name, the cost of maintaining status quo.

- The tangible losses and sometime profits :) That results from not doing anything.

WHAT YOU LOSE OR GAIN

Some stats for context setting

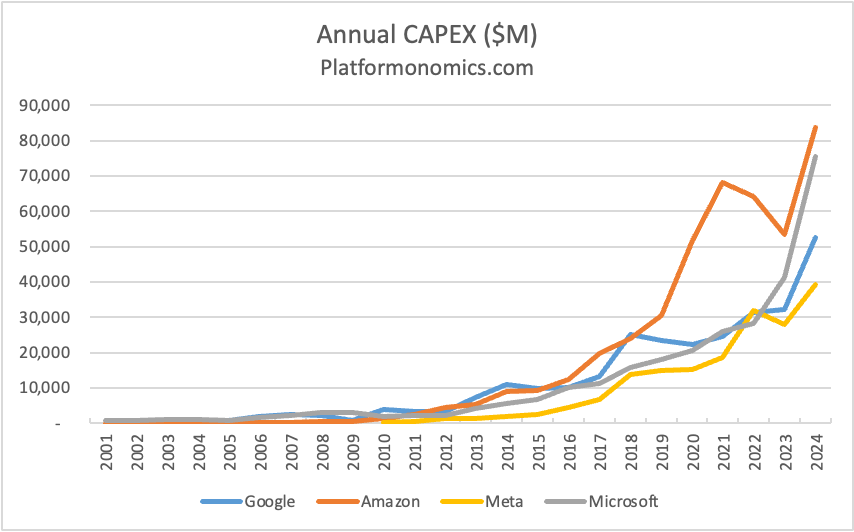

- As per data only the four hyper Capex firms(Apple, google, Meta and microsoft) spent 250 bn USD in 20243 See below.

- & that of S&P 500 companies was 1 Trillion USD for 2024.

FUN FACT: Meta, one of the biggest hyperCAPEX spender, spent more on CAPEX in 2024 than outspoken nanocloud promoter Oracle has in its nearly 50 year history. :)

Top 17 challenges (Sustainable development goals) listed by United nations require ca. 4.2 trillion usd per year.

So ca. a 4th of these can be addressed by identifying and diverting investments in failed transformation capex.?

Mind blowing isn’t it?

I totally get it – why organizations invest in all the big multi year projects. It’s a chance to invest in R&D and a chance to drive growth in organizations. Yes its fun to start new projects.

Yes, none of the organization’s want to be repeat:

- What Kodak did in 1975, when it was the company inventing digital camera in 1975 but chose not to act on this idea.

- When Blockbuster had the chance to buy then Netflix which was worth 50 mn USD. btw it later filed for bankruptcy in 2010.

You miss all the shots you don’t take.

//Wayne Gretzky

Off course you miss 100% percent of shots which you don’t take.

But you don’t aim for a 3 pointer from the other end of the basket ball court. or do you.

Playing Devils advocate for Cost of doing nothing.

I do want to play devil’s advocate for CODN here but when History is full of examples and statistics show time and again – 70% of all programs drastically fail to achieve outcomes.

History is full of examples when cost of action led otherwise:

- The AOL and Time warner merger in 164€ bn deal was the largest in US history at that time. But a clash of cultures, tech bubble and other inefficiencies led to 100 bn usd write offs.

- 200 years when Napolean took action to invade Russia with the largest army of 600k men. But it was such a big logistical and military catastrophe that it led to his exile and beginning of end of his empire.

Sunk cost fallacy – Can’t quit now

Simply put its the urge and inability of the organizations and persons to continue investing or doing something when its clear that its doomed for failure.

Smart people cut losses when they no longer make sense. Fools double down to avoid accepting the loss.

Ongoing AI mad rush – Taking cues from current technology landscape, every organization is in rush to implement AGI and use cases. The massive investments being made are unthinkable and humorous sometimes. When the outcome reports are already coming, it is clear that most are acting without calculating ‘Opportunity cost’.

Are we well on track to repeat the 70% failure rate again in AI gold rush? time will tell.

So to summarize..

Build baby build had been the mantra for most of the organization for most of the time justifying cost of doing nothing. But a small analysis and to stop or pivot from a investment proposal goes a long way.

Investing that Capex investment when 70% of the projects are doomed to failure in some other OpEx can also help sometimes.

What is your cost of action or opportunity cost for the business or side project you are working on?

Before you double down and approve that multimillion capex projec.

Have you calculated the cost of doing nothing for that project? or are you (un)knowingly following sunk cost fallacy?

Well for me, I still haven’t figured a good answer to question on ‘Why do i want to compete in 90km x-country skii’. Perhaps its the CODN :).

Until next time.

//Chakshu Arora

References:

- One of the longest cross country ski race in the scandinavia. https://www.vasaloppet.se/en/races/ski-races/vasaloppet/ ↩︎

- https://www.mckinsey.com/capabilities/operations/our-insights/the-construction-productivity-imperative ↩︎

- https://platformonomics.com/2025/02/follow-the-capex-cloud-table-stakes-2024-retrospective/ accessed october25 ↩︎

I would love to hear your thoughts and comments on this post :) //CA